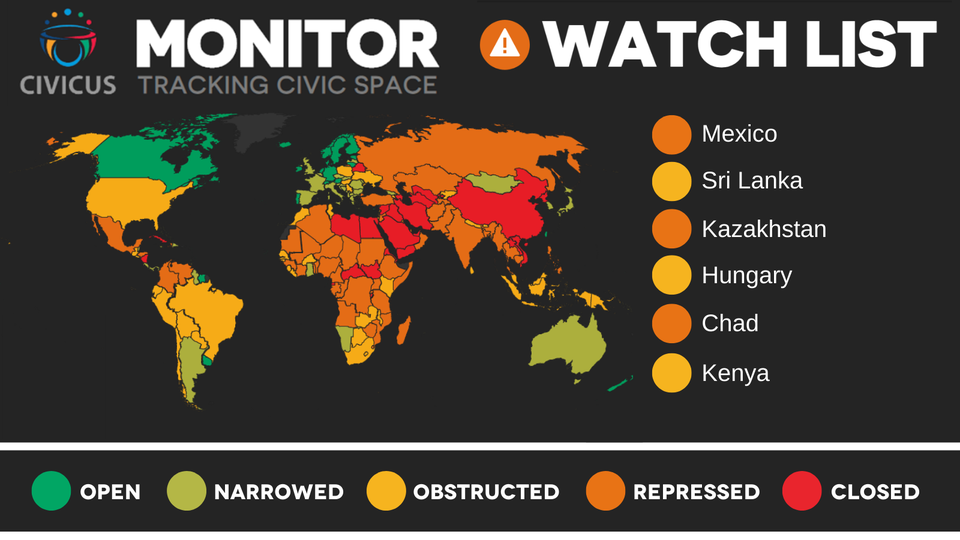

The Coalition for Economic Democracy in Sri Lanka (CEDSL) is a group of concerned academics, activists, agricultural, fisheries and industrial workers, students, business persons, trade unionists, and professionals based ‘in country’ and overseas, including the diaspora, who uphold the values of economic rights and justice in public policy making.

In the wake of two years of economically-devastating COVID-19 lockdowns, quantitative easing, and money printing globally, we call on international actors to heed the people’s demands for a ‘debt jubilee’ and ‘cancellation’ as a priority.

We wish to draw your attention to key issues regarding the current debt crisis and its social, political and economic impacts which are not adequately represented in public discussion, yet crucial to the wellbeing and security of Sri Lanka’s citizenry.

“The gross lack of transparency in ongoing negotiations between the IMF and a government that lacks legitimacy but purports to represent the citizens is a consequence of an inherently unequal relationship between Sri Lanka and the IMF, where the US and former European colonial powers have overwhelming decision-making power. While the IMF demands ‘transparency’ and that all creditors be treated ‘equally’, the names of the ISB holders behind Sri Lanka’s default are a closely guarded secret”

A call for debt justice

International support is welcome to ease the economic burden on the people of Sri Lanka which includes shortages of fuel, food and medicines that impact livelihoods and health, increasing poverty and inequality. However, due to an International Sovereign Bond (ISB), debt trap and depreciation of the Sri Lankan rupee against the US dollar, sustainable solutions are needed rather than short-term sale of strategic assets that benefits ISB holders and hedge funds that sustain dependent development.

In May/June 2022 Sri Lanka’s debt was estimated to be $ 51 billion with current debts of $ 5 billion to be paid to ISB holders and hedge funds like BlackRock, which secured huge United States (US) government ‘COVID-19 bailout’ funds to asset-strip and impoverish countries around the world during the economically-devastating COVID-19 lockdowns.

Contrary to widespread media disinformation about the sources of debt and the causes of default, this is the first time that Sri Lanka, in April of this year, defaulted as an independent state. It is the debt owed to ISBs that amounts to almost 50% that has caused the default at this time.

The Asian Development Bank and World Bank have indicated willingness to roll over their multilateral debt, so too the bi-lateral debt holding Asian countries including Japan, China and India. Along with debt cancellation there is need for de-dollarisation and trading in a basket of currencies. The loss of such autonomy and sovereignty due to the ISB debt trap and the International Monetary Fund (IMF) stepping in to devalue the currency is at the root of the current shortage of food, fuel, meds, fertiliser, gas, etc. The purported shortage of ‘exorbitantly privileged’ dollars is the most devastating impact of the entire “staged” default.

While the return of stolen assets by the Rajapaksa family, some who are US citizens, is vital, we believe that there is an even greater need for ‘debt justice’, a ‘debt jubilee’, and ‘debt cancellation’ and the current international financial architecture is not fit for purpose, particularly, the IMF which works for the global 1 percent and imposes austerity on the rest.

Transparency in IMF negotiations

The gross lack of transparency in ongoing negotiations between the IMF and a government that lacks legitimacy but purports to represent the citizens is a consequence of an inherently unequal relationship between Sri Lanka and the IMF, where the US and former European colonial powers have overwhelming decision-making power. While the IMF demands ‘transparency’ and that all creditors be treated ‘equally’, the names of the ISB holders behind Sri Lanka’s default are a closely guarded secret!

In 2019, Sri Lanka was classified by the World Bank as an Upper Middle Income Country (MIC), making it ineligible for concessionary development loans, and forcing it to borrow from private capital markets at high interest rates. The new government that came to power cut taxes causing a significant loss of government revenue. The 2019 Easter bombings and policies undertaken during two years of militarised COVID-19 lockdowns and mass injections have triggered the current debt crisis leading to the staged default.In 2019, Sri Lanka was classified by the World Bank as an Upper Middle Income Country (MIC), but just three year later in 2022 certain international actors want Sri Lanka to be re-classified a ‘Least Developed Country’ (LDC), and the island to join the world’s poorest of the poor1 – in Washington Consensus parlance, a “Highly Indebted Poor Country” (HIPC).

LDC status will mean a significant loss of economic and foreign policy autonomy and sovereignty at a time when it is vital that Sri Lanka and other developing countries act in their own self-interest rather than be forced to join geostrategic blocs that are being formed in the Indian Ocean region such as the QUAD at this time of Cold War 2.0.

We consider that the peoples’ sovereignty and national policy autonomy is being undermined through non-transparent deals with politicians who are not democratically elected and have a history of amassing ‘odious debt’, the burden of which citizens are being forced to bear. Particularly notable on the accumulation of odious debt are the current odious, newly appointed Prime Minister, implicated in the country’s biggest financial fraud over the Central Bank bond scam, and the President, a US citizen until 2019, whose family wallows in nepotism. They are now negotiating with the IMF to sell national assets?!

There is a clear pattern of disinformation, exaggeration and fear-generation regarding Sri Lanka’s debt in local and global media messaging. This understates the intrinsic Wealth of the Nation, its strategic assets, and the strengths of this country given the failure to differentiate between illiquidity and insolvency in the context of a proposed IMF fire sale of assets and State Owned Enterprises (SOEs).

The IMF’s traditional approach to debt restructuring though privatisation of SOEs, austerity measures, and fire sale of assets of countries merely causes more problems and places the burden on the poor as is evident in from Argentina, to Greece and Lebanon. However, odious debt is an outcome of speculative and reckless ISB lending sans due diligence to governments that lack legitimacy and are known to be corrupt. In fact, the IMF which works for the Global 1 percent is a part of the problem and not the solution. So too are processes of datafication, manipulation of matrices, indices and algorithms to ensure ‘pumping and dumping’ of countries into the MIC debt trap, LDC or HIPC status and Paris Club ‘solutions’ of asset stripping of countries.

“International support is welcome to ease the economic burden on the people of Sri Lanka which includes shortages of fuel, food and medicines that impact livelihoods and health, increasing poverty and inequality. However, due to an International Sovereign Bond (ISB), debt trap and depreciation of the Sri Lankan rupee against the US dollar, sustainable solutions are needed rather than short-term sale of strategic assets that benefits ISB holders and hedge funds that sustain dependent development”

Southern voices to be heeded

There is an urgent need for Southern voices and perspectives in development, debt cancellation and debt justice in the International Aid Architecture as many countries in the Global South face a similar situation of odious debt as an outcome of speculative and reckless lending by ISB traders who must be also held accountable.2

The demand of many Sri Lankans is for debt cancellation and de-dollarisation and trading in a basket of currencies, not IMF re-structuring; for example, to enable the purchase of discounted oil and gas from sanction-hit Russia perhaps in exchange for tea. Sri Lanka should have the economic and foreign policy sovereignty to source its needs from any country that offers good value for money.

A firm “No” to IMF fire sale of strategic assets and asset stripping: A list has already been prepared of strategic lands, airports, ports, transport, telecom frequencies and energy infrastructure to be privatised. The dastardly sale of the Yugadhanavi power plant US-based New Fortress has already further compromised national security and policy sovereignty and autonomy.

Today the interests of Sri Lanka are being represented by foreign law firms, Lazard and Clifford Chance in so-called IMF negotiations with ISB traders. On numerous occasions, Lazard, which has been involved in both advising on privatisation and then profiting from its advice, has undervalued the price of state companies, enabling its asset management branch to purchase the stock at low prices and re-sell it for considerable profit.3

If the debt negotiations are so complex that Sri Lankan law firms and accountants cannot represent the interests of the citizens of the country, and the debt data is itself contested, the debt is odious, its holders unknown, and the negotiations not transparency, then fundamental question arise regarding legitimacy, transparency and accountability of the very process of so-called IMF negotiations. Such concerns were also raised in IMF negotiations in Greece, Lebanon and Argentina and other countries.

The United Nations Charter and international law affirm the Right of Peoples to Self-Determination and permanent sovereignty over their wealth, resources and economic activity as a precondition for the realisation of all human rights. So too, principles of sovereignty and independence of states, equality in relations with other states, and national policy-making autonomy cannot be eroded by global Covid-19 and other ‘pandemic’ and climate catastrophe narratives.

Sustainable solutions: Long-term, medium-term, short-term

We seek much more than debt relief, and demand ‘debt justice’! While the crisis in Sri Lanka is being framed as a “humanitarian disaster” it is quite clear that it is more complex with economic, political, social and geopolitical dimensions and dynamics.4 Solutions must hence be duly designed, tailored and targeted to improve the lives of the most vulnerable, and to restore sovereignty to the people of Sri Lanka and their State.

1. We demand a ‘debt jubilee’ and to write off the odious debts held by ISB debt holders like BlackRock (that also holds Adani stock), that engaged in reckless lending that has debt trapped several countries including Sri Lanka. COVID-19 saw the greatest transfer of wealth in human history from the bottom of the economic ladder to the top.

2. We call on the Government to urgently begin a process of de-dollarisation and trade in a basket of currencies in order to restore Sri Lanka’s monetary sovereignty and pursue a course of development that promotes South-South cooperation and responds to the needs and aspirations of the Sri Lankan citizenry. The relevance of the current International Development Architecture for Sri Lanka and other debt trapped countries in the Global South must be questioned. Sri Lanka needs to reconsider its relations with institutions like the IMF, WB, OECD, Paris Club of Donors in a manner that affirms not dismantles its sovereignty and policy autonomy, both exercising the ability to negotiate as an independent country free of IMF conditionality and US sanctions, and working in the interests of its citizens.

3. We call on the Government to immediately stop all initiatives and actions underway for the privatisation of strategic assets, including lands, airports, ports, telecom frequencies, transport and energy infrastructure, and reverse all actions already commenced or implemented as valuations did not consider the island’s geostrategic value and security concerns.

4. We call on the Government to develop a National Energy and Food Security Policy based on analysis take cognisance of the current global energy wars, geopolitics and climate catastrophe discourses. Of utmost importance in ensuring food security is the maintenance of food supply chains, and prioritisation of fuel for the Fisheries and Agriculture sectors in the context of fuel rationing; rationalisation of taxation, and targeting the wealthy – to enable the most vulnerable groups such as farmers, fishers precarious workers in the informal sector, and small and medium term enterprises to regain their livelihoods. In the absence of such a policy, climate narratives like the rush to “green energy” and organic fertiliser without an adequate transition plan and transfer of technology given the island’s tiny carbon footprint has contributed significantly to the current fuel, food and economic crisis in Sri Lanka and in other parts of the Global South.

5. The strengthening of governance and government institutions is paramount to address the effects of COVID-19 lockdowns which gave rise to a pandemic of corruption and a lack of accountability due to national institutions and oversight agencies being debilitated under the guise of lockdowns, holidays due to staged fuel shortages, de-centralisation and inept digitalisation. Services like public transport can be improved through more energy efficient and environment friendly measures and the abolishing of duty free car permits for politicians and the privileged ‘professional’ class. Finally, there is an urgent need for a “Buy local” State-led consumer education program so that citizens support local industry and manufacturers.

On 24 June, 2022, this statement was authored and signed in Sri Lanka, France and Australia by:

Tamara Kunanayakam was Sri Lanka’s Ambassador/Permanent Representative to the United Nations at Geneva, and former Ambassador to Brazil and Cuba. She served as Chairperson/Rapporteur of the United Nations Intergovernmental Working Group and senior official at the UN Office of the High Commissioner for Human Rights (OHCHR).

Dr. Darini Rajasingham-Senanayake is a social and medical anthropologist with research expertise in international development and political economic analysis. She was a member of the International Steering Group on “Southern Perspectives on Reform of the International Development Architecture”.

Jeremy Liyanage was a teacher of the Social Science, lecturer in Community Development and held positions in the church, community and government sectors. Before founding the charity, Bridging Lanka, Jeremy worked in senior policy positions in local government in Australia.

“Along with debt cancellation there is need for de-dollarisation and trading in a basket of currencies. The loss of such autonomy and sovereignty due to the ISB debt trap and the International Monetary Fund (IMF) stepping in to devalue the currency is at the root of the current shortage of food, fuel, meds, fertiliser, gas, etc. The purported shortage of ‘exorbitantly privileged’ dollars is the most devastating impact of the entire “staged” default”

Co-signatories

Professor Asoka Bandarage – academic and distinguished (adjunct) professor at the California Institute of Integral Studies. She taught at Yale University, Brandeis University, Macalester College, Georgetown University, European Peace University and Mount Holyoke College, MA where she received tenure

Dr. Michael Roberts – Historian and lecturer at the Dept. of History at Peradeniya University (1961-76) and the Dept of Anthropology at Adelaide University (1977-2003). Rhodes Scholar. His major works are in agrarian history, social mobility, nationalism and ethnic conflict

Dr. Dharshana Kastiriaratne, Assistant Professor, Faculty of Computing, Computer Science and Software Engineering, Sri Lanka Institute of Information Technology (SLIIT)

P.C. Nathan – Deputy Secretary General of Ceylon Mercantile and General Workers Union (CMU), one of the largest trade unions in the commercial sector in Sri Lanka

Ranjit Seneviratne – Marine Engineer and former official with the FAO in Rome who now champions non-chemical, biodiverse ‘forest garden’ methods of cultivation

Dr. Sandya Hewamanne – Professor of Anthropology, Department of Sociology at the University of Essex, and the Director of IMPACT-Global Work

Lacille De Silva – former Director, Administration, and former Director, Legislative Services, Parliament of Sri Lanka

Rohini Hensman is a writer, independent scholar and activist working on workers’ rights, feminism, minority rights and globalisation based in Mumbai and London.

Hiran Fernando – is a retired Chemical Engineer who worked at Unilever for more than 25 years and is now involved in civil service initiatives

Ananda Weerasekere – retired Human Resource Management Specialist and Social Activist

Gamini Lindagedara – Mechanical Engineer and Social Activist

Herman Kumara – National Convener, National Fisheries Solidarity Movement, Chairperson, Praja Abilasha Land Rights Network and Board Member, Right to Life Human Rights Organization

Sandun Thudugala – Director, Programmes and Operations at Law & Society Trust, Colombo

Asoka Siriwardena – Formerly Lecturer in Political Science; international civil servant at the Commonwealth Telecom Organization London, and retired Deputy General Manager Sri Lanka Telecom.

Footnotes:

1. Should Sri Lanka join the ranks of the “Poorest of the World’s Poor”?

http://www.lankapage.com/NewsFiles22/Jun13_1655134777.php

2. Cf. OXFAM report “Inequality Kills”.

3. The Privatization Industry in Europe by Sol Trumbo Vila and Matthijs PetersTransnational Institute Thttps://www.tni.org/files/publication-downloads/tni_privatising_industry_in_europe.pdf

4. A new Quad Humanitarian and Disaster Relief Mechanism (HADR) http://www.colombopage.com/archive_22A/Jun15_1655268284CH.php

Source: DailyFT