Sri Lanka is in talks with banks in the Middle East for financial facilities amounting to two billion US dollars, State Minister for Samurdhi and Micro-Finance Shehan Semasinghe said.

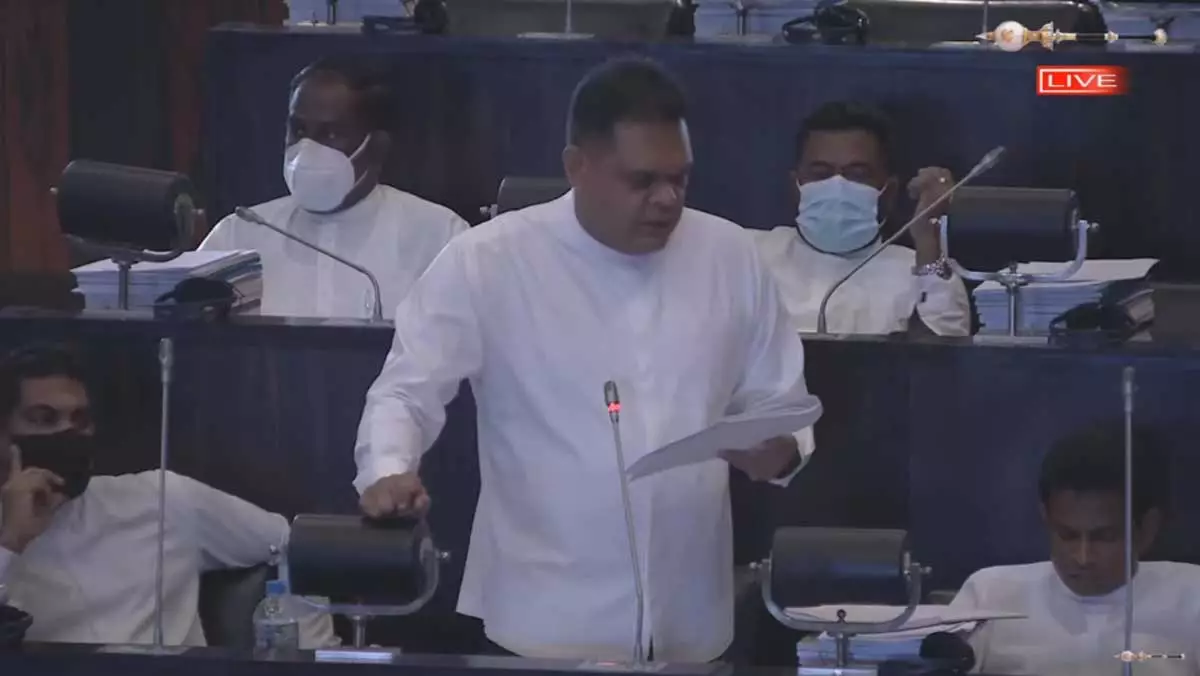

“Discussions have been initiated with banks in the Middle East for 2.0 billion dollars in financial facilities,” Minister Samarasinghe told parliament.

“Successful results are starting to emerge.”

Sri Lanka is seeing pressure on the rupee peg of 200 to the US dollar, depletion of foreign reserves and parallel exchange amid liquidity injection made to maintain low interest rates.

Sri Lanka has 6.9 billion US dollars of foreign exchange denominated debt to be paid, including to domestic holders.

Sri Lanka repaid a 500 million US dollar sovereign bond in January and a billion dollar bond remains to be paid in July.

Gross foreign reserves were down to 2.3 billion US dollars in January. From October, foreign reserves started to be used for imports, which requires more money printing to keep rates down. Fuel shortages have started to emerge.