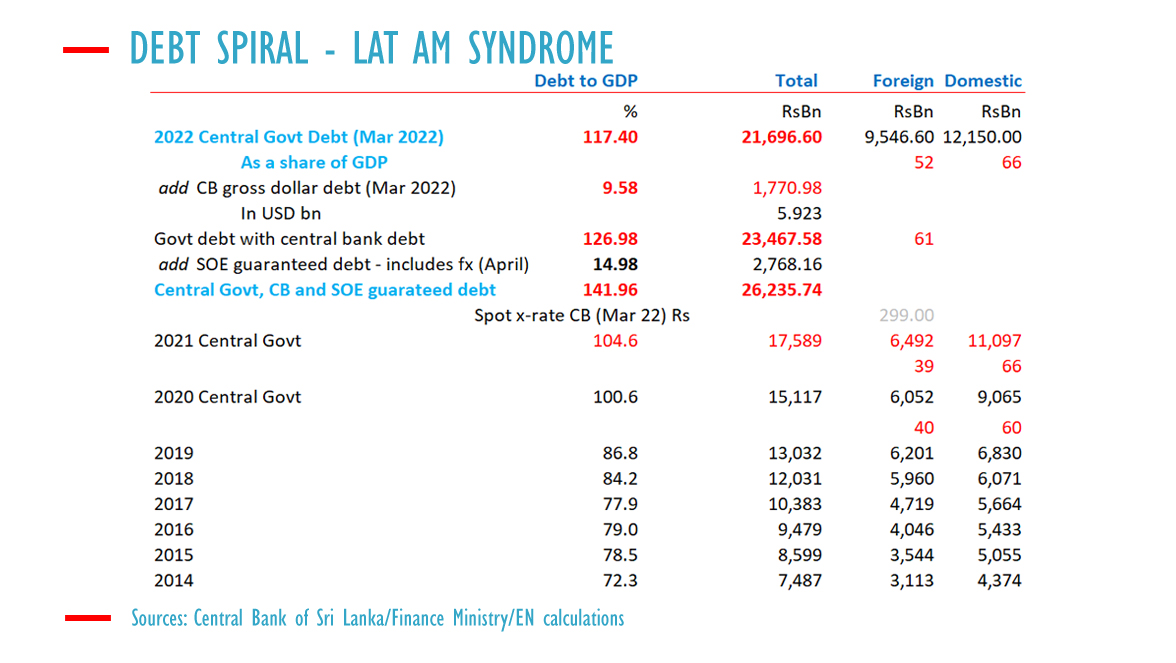

Sri Lanka’s government debt has surged to around 126 percent of gross domestic product by the first quarter of 2022, with central bank debt contributing close to 10 percent of GDP in foreign debt, official data shows.

Sri Lanka’s central government debt rose to 21.6 trillion rupees of 117.4 percent of revised GDP by March 2022, from 104.6 percent as a ‘flexible exchange rate’ or soft-peg collapsed from 200 to 360 to the US dollar weighed down by a surrender requirement and low rates.

Government with central bank debt rose to 127 percent of GDP with the monetary authority borrowing money to finance either imports or debt repayments after printing money.

Gross central bank debt was around 9.58 billion rupees by March 2022.

About 1.8 billion in gross reserves borrowed from China are left with the central bank unable to use it due to prudential rules placed by China.

Goverment guaranteed debt of state enterprises topped 14 percent of GDP by April 2022, according to finance ministry data, taking the total to at least 140 percent of GDP.

By April however the rupee had depreciated further.

Sri Lanka’s central government debt started to climb with monetary instability worsening from the third quarter of 2014 with aggressive liquidity injections.

Sri Lanka was hit by currency crises in 2016 and 2018 as the central bank injected money through overnight repo, term repo and outright purchases of government securities driving up debt and slowing growth after each currency collapse.

Monetary instability came under ‘flexible’ inflation targeting and output gap targeting (printing money to boost growth) and the currency was allowed to depreciate after printing money through REER targeting a type of BBC (band, basket, crawl) policy advocated by Mercantilists in the 1980s.

In the seven years to 2022 there was monetary stability only in 2017 and 2019.

Sri Lanka’s central government debt ratcheted up from 72.3 percent of GDP in 2014 to 86.6 percent by 2019.

Source: Economy Next