The European Union (EU), which raised concerns about the proposed counter-terrorism bill has requested the government, among others, to narrow down its definition, an official familiar with the process said.

The Protection of the State from Terrorism Act (PSTA) is the proposed piece of legislation in Sri Lanka intended to replace the Prevention of Terrorism Act (PTA) — a law first enacted in 1979 that has been widely criticised domestically and internationally for enabling human rights abuses, arbitrary detention, and repression of dissent.

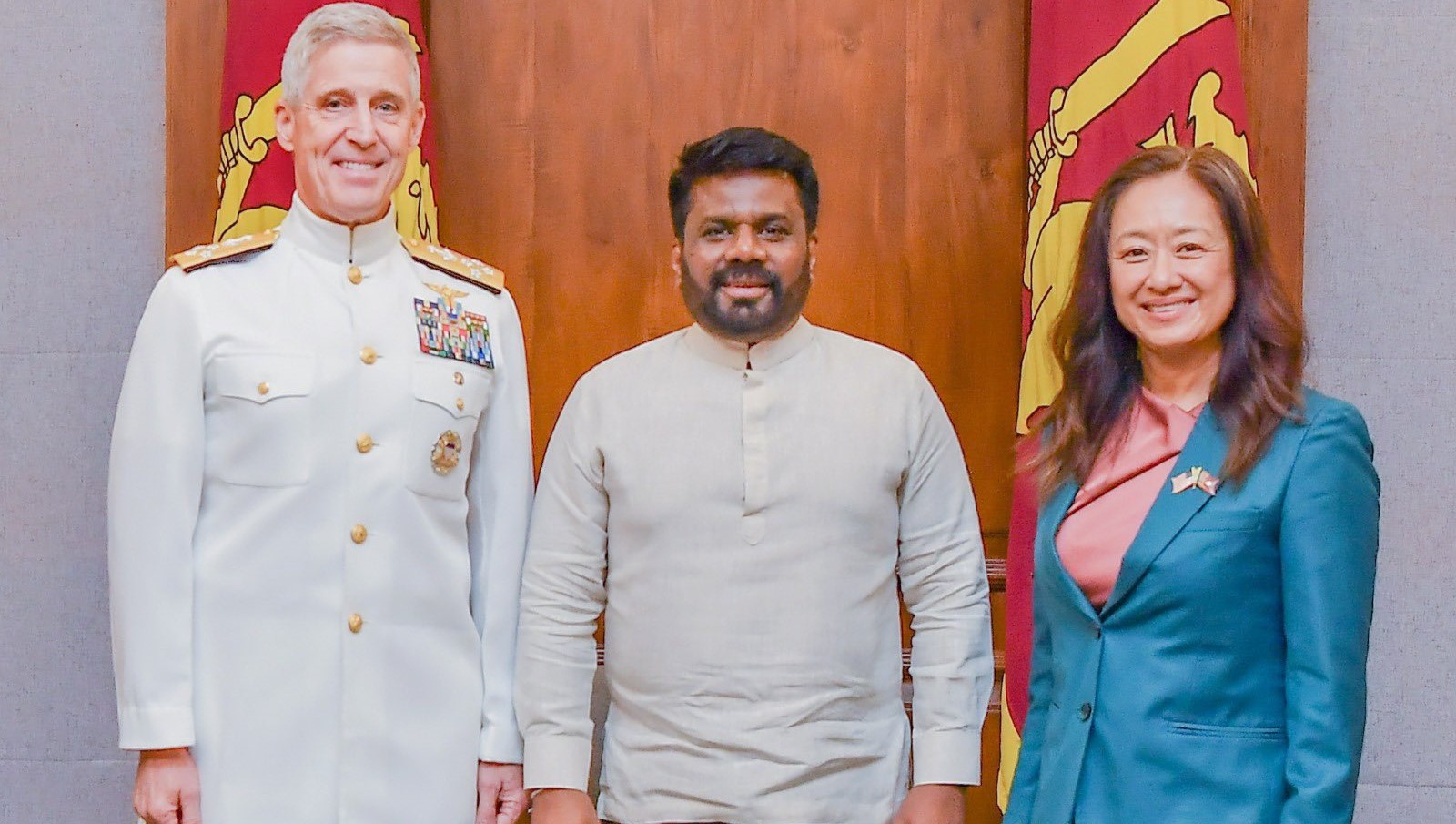

The previous government led by Mr Ranil Wickremesinghe worked out the anti-terrorism bill. However, instead of this bill, the new government led by President Anura Kumara Dissanayake introduced the PSTA and presented it for public consultation.

An official familiar with the evolution of PSTA said that the EU had sent a detailed response to be considered in the enactment of the new legislation in place of the PTA. The official said the EU, among others, wants the definition of terrorism to be narrowed in conformity with international standards.

Earlier, critics warned that the bill defines terrorism in very wide terms — for example including acts that intimidate the public or cause terror, which can be interpreted expansively and could risk criminalising peaceful protest, civil society actions, or political dissent. Like the PTA, the draft PSTA permits extended detention without charge, extraordinary arrest powers, and expanded executive authority, though under a new legal armoury. These provisions have raised alarms that the law could be used to detain individuals arbitrarily.

The Justice Ministry is currently in the process of narrowing down the definition listing offences to reach the threshold of terrorism according to international norms.

The repeal of the current PTA to be replaced with a new counter terrorism law that conforms to international standards has been stressed by the EU for Sri Lanka to qualify for the GSP + trade scheme under the revised criterion.