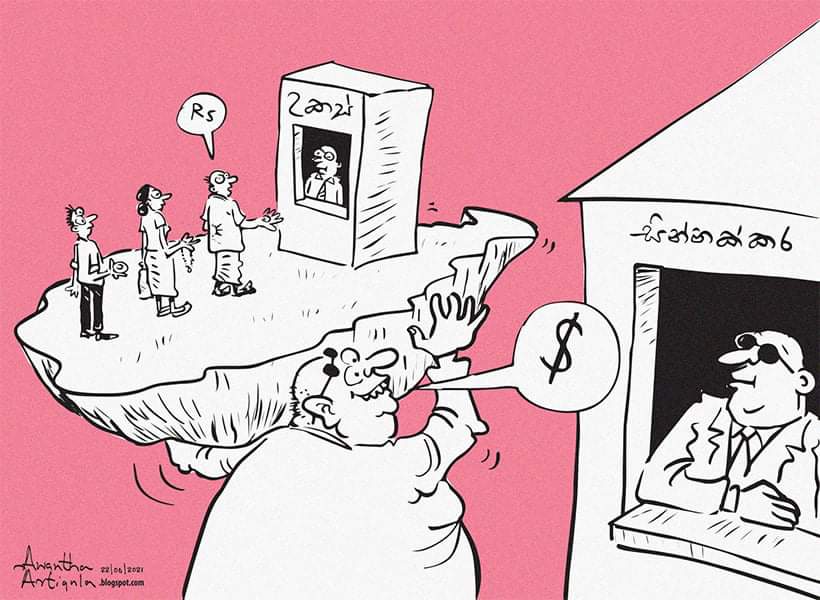

Rohan Parikh, Managing Director of Iconic Developments has urged the authorities to find solutions to resolve gaps in the real estate market and the Forex crisis. Speaking at a Webinar organised by the Ceylon Chamber of Commerce on Tuesday (16), he said there is a correlation between house prices, building materials and exchange rate depreciation, especially when one is considering a high import-dependent economy.

Referring to the Forex crises, people would ask him, ‘Why are you investing in Sri Lanka, when ROI is not guaranteed? Why don’t you invest in Dubai?’ Parikh’s response was, the issue is short term, hence, he anticipates medium to long term returns. “For someone considering global real estate investments, Sri Lanka is still not on the lines of Dubai and Singapore,” he said.

Furthermore, he said restrictions on foreigners holding land on free hold basis were a hindrance to the development of the ‘Villa’ concept in Sri Lanka. With regard to attracting foreigners to buy high end apartments, Parikh said one of the reasons for a foreigner to buy an apartment home in another country is to have a second home. “How do you attract a foreigner to buy an apartment home in the heart of Colombo? Though the Port City is coming up, and the concept of making Colombo into an entertainment and financial hub is much spoken about, still it is not something of the present.

So, we need to convince a foreigner to buy an apartment home in Colombo based on something of the future. “In the last three years, unfavourable developments like the Constitutional crises, Easter Sunday attacks and the current Forex crises have not helped developers to attract foreign buyers. “Cement and steel make up 40% of real-estate project costing. In Colombo, 20% of project cost is land, while 80% relates to construction.

In cities like Mumbai, it is the reverse, 80% for land and 20% for construction. The current import restrictions in Sri Lanka would further increase construction cost, which will make apartment costs to rise.” he said. When asked whether there is an oversupply of real estate in Central Business District of Colombo, he said. “It is a wrong supply and not over supply. Too many players got into supplying apartments to the value of Rs 100 million. There is a market for semi-luxury apartment units at the range of Rs 60 to 80 million,“he said.