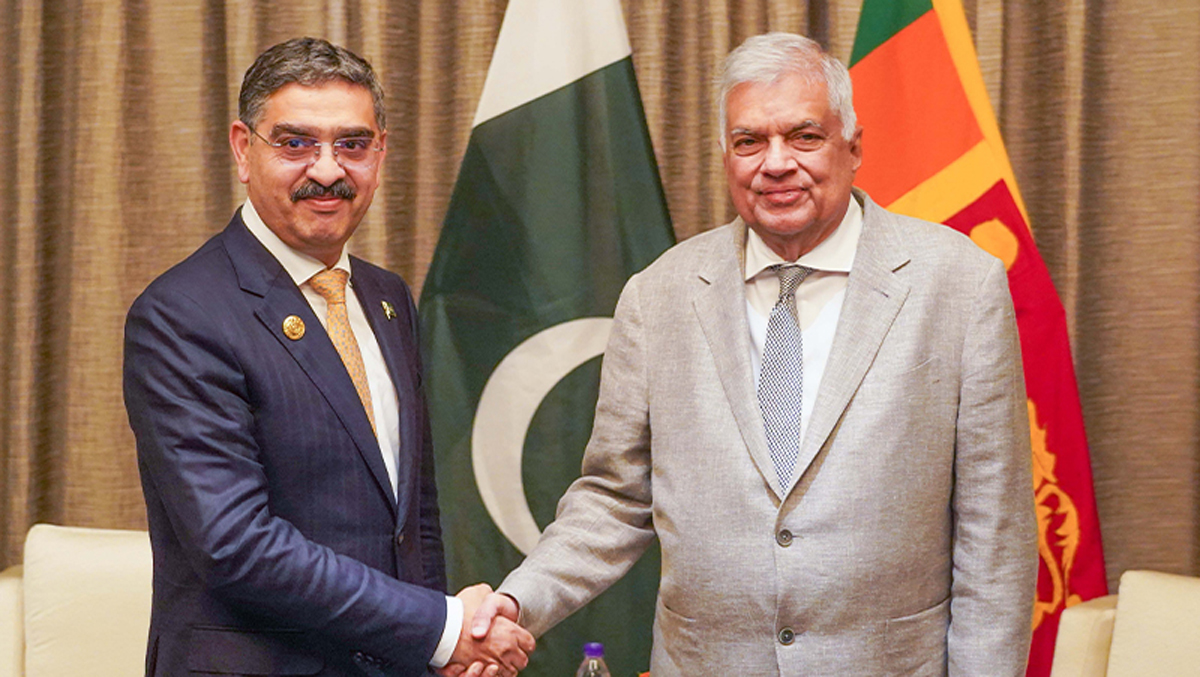

Sri Lanka’s President Ranil Wickremesighe and Pakistani prime minister Anwaar-ul-Haq Kakar to discuss economic crises and recovery in their respective countries at a meeting in China.

President Wickremesinghe and Prime Minister Kakar engaged in “an extensive discourse concerning the economic crises” that affected the two countries with a particular focus on strategies for recovery, on October 17, a statement from the President’s media office said.

The two leaders are attending a summit involving China’s One Belt, One Road initiative. Both countries borrowed from China to build infrastructure.

Sri Lank and Pakistan have the worst anchor conflicting soft-pegged (now called flexible exchange rate) central banks in South Asia, and often go the International Monetary Fund.

Pakistan went into a crisis within an IMF program and it was aborted and a fresh one struck. Sri Lanka went into default in between two programs with a bigger gap.

Bad money central banks impose extensive import and exchange controls instead of curbing their open market operations and the obsession to cut rates with printed money.

The flexible exchange rate which is neither a clean float nor a hard peg is the in-vogue inflationist, ‘impossible trinity’ monetary regime, which defies laws of nature and is found in recently defaulting countries, critics say.

Sri Lanka’s rupee fell from 181 to the US dollar in January 2020 to 360 by April 2022 and has since appreciated to 323 after money printing was halted and reversed.

Pakistan’s rupee fell from 154 to 279 to the US dollar in the same period.

Sri Lanka and Pakistan suffered identical problems due to liquidity injections including inability to open letters of credit through the formal banking system, wide parallel exchange as a result credit given with printed money which drove remittances off official channels.