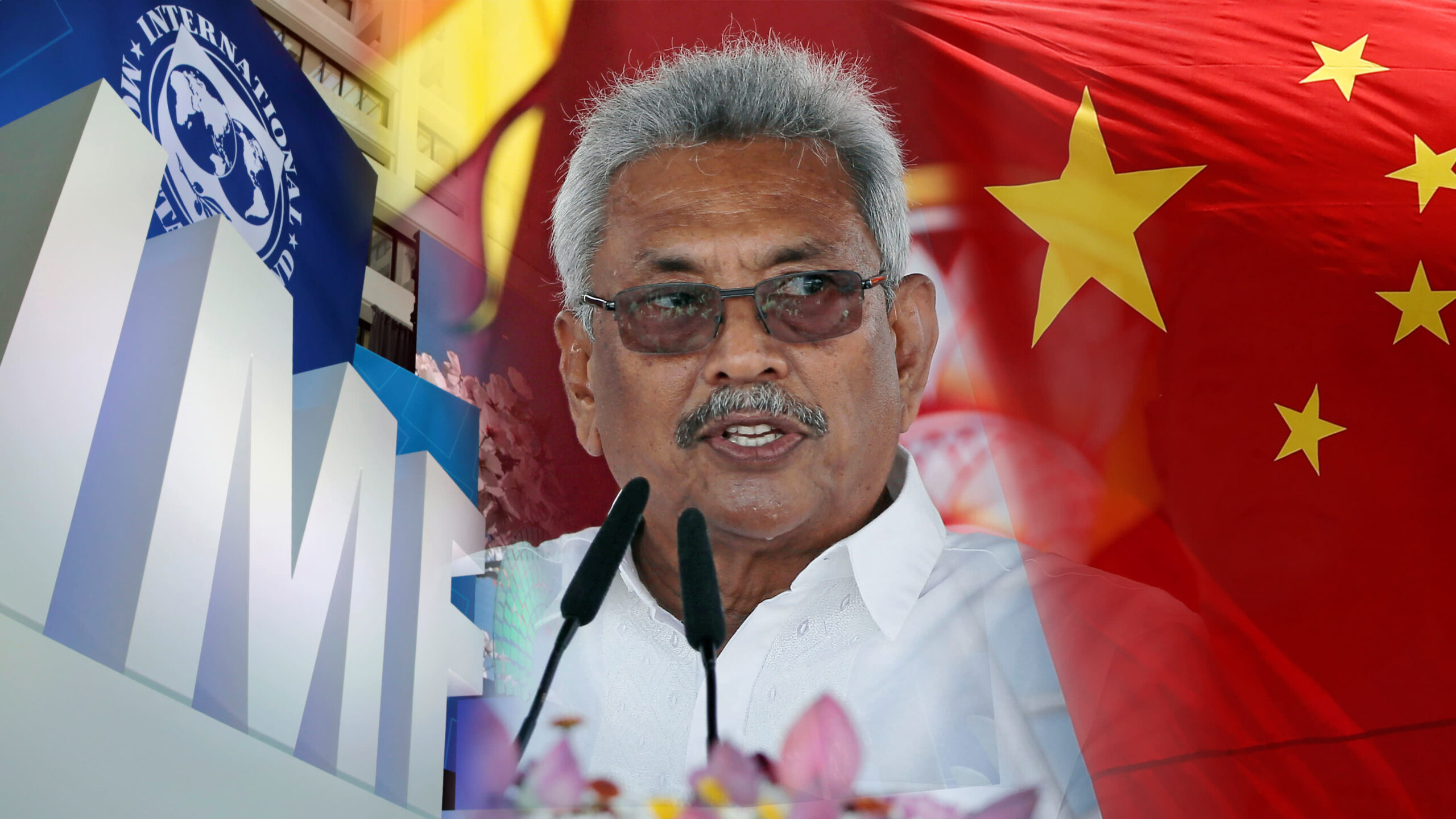

Sri Lanka ministers had “exchanged views” on an International Monetary Fund bailout for the second week in a row but no decision had been made, a minister said as the country continued to face an external amid money printing.

He said “different views” (vividher adahas) were expressed by ministers.

“Ministers expressed their individual views (thummer-tha-mun-gay muther) clearly at this cabinet and the last one,” co-cabinet spokeman Dallas Allahapperuma said.

“There was no collective decision. Especially when the Finance Minister (Basil Rajapaksa) is out of the country there is no possibility of reaching a decision in any case.”

Rajapaksa is currently visiting the US.

Dallas Allahapperuma said in 2008 when Sri Lanka’s civil war was peaking, oil prices were soaring and there was a global crisis, the administration headed by President Mahinda Rajapaksa had gone to the IMF.

“To discuss a program is one thing, to accept their conditions is another matter,” Allahapperuma said.

Sri Lanka has been resisting going to the IMF saying unacceptable conditions would be imposed on the country.

Trade Minister Bandula Gunewardene told reporters on Monday that the IMF would ask to cut the bloated public sector, reduce the budget deficit, make state enterprises profitable, and raise fuel and electricity prices.

It was before fuel prices were raised at midnight on the request of the central bank.

A few days earlier, Dayasiri Jayasekera, a minister representing ruling coalition partner Sri Lanka Freedom Party said after last week’s cabinet meeting that the IMF imposes conditions such as making state enterprises profitable.

“It is a good thing to do that,” Jayasekera said.

Finance Minister Basil Rajapaksa had already said the state workers and state enterprises were a big burden on the economy.

Older IMF baiout programs typically involve cutting the deficit with tax hikes (revenue based), trimming expenses (spending based) expressed as a net domestic finance target, a foreign reserve target and a reserve money target.

However Sri Lanka’s last failed extended fund facility from IMF program where money was printed within the program to create forex shortages and worsen foreign debt, an inflation target was given and the budget target was defined as a primary deficit.

Instead of a measurable reserve money or ceiling on central bank credit an inflation target was given, allowing the trigger happy central bank to print money and trigger a currency crisis within the program.

Under revenue based fiscal consolidation, state spending soared and the currency collapsed from 151 to 183 under a so-called flexible exchange rate where the exchange flipped from pegged to floating rapidly and interventions were sterilized on top of it.