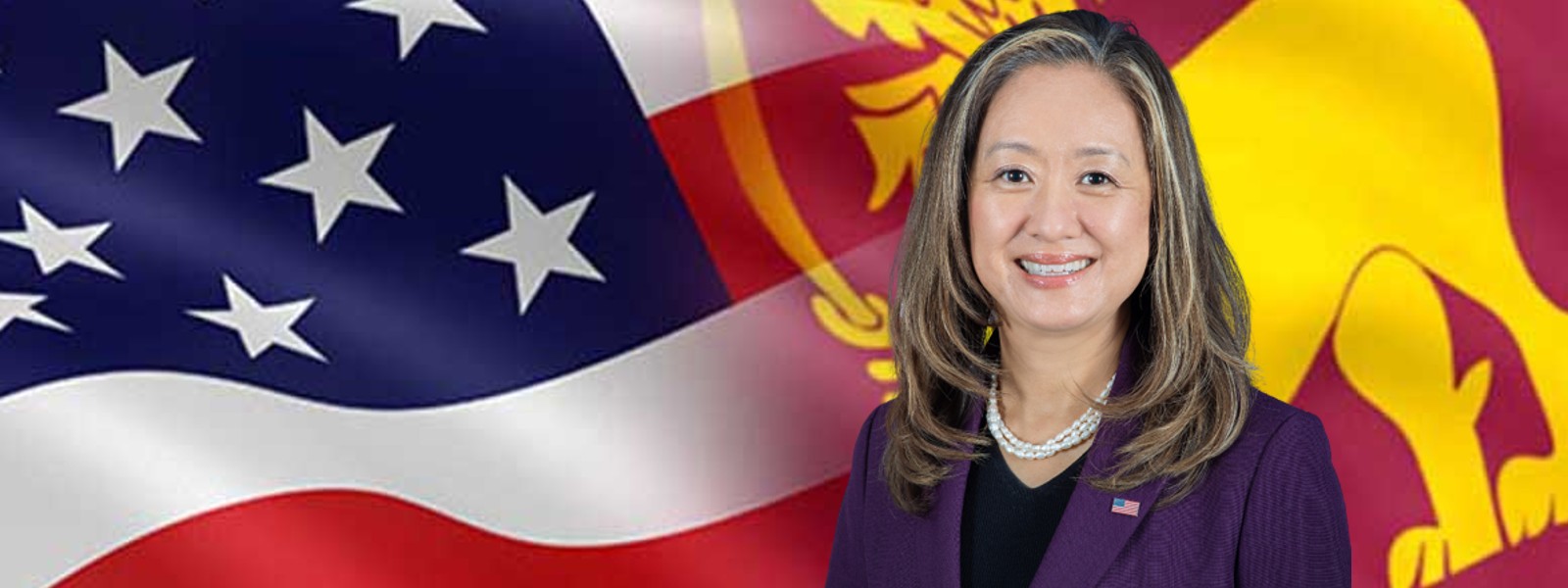

The United States has reinforced the need for fairness in Sri Lanka’s debt restructuring efforts, with Ambassador Julie Chung noting that equal and equitable treatment for all creditors is essential and that transparency from every party involved is crucial.

The US remains committed to an economic landscape that values fairness, transparency, integrity, and inclusivity, ensuring stability and growth in Sri Lanka, Chung said following a meeting with Central Bank Governor Nandalal Weerasinghe.

Chung tweeted Wednesday October 25 afternoon that she had extended her congratulations to Weerasinghe on the staff level agreement reached with the International Monetary Fund (IMF) on the first review of its 2.9 billion US dollar extended fund facility (EFF).

The diplomat said the agreement marked progress in Sri Lanka’s effort to secure the second tranche of the IMF loan.

“I reinforced the need for fairness in Sri Lanka’s debt restructuring: equal and equitable treatment for all creditors is essential. Transparency from every party involved is crucial,” she said.

The US ambassador’s remarks come after China’s EXIM Bank agreed on “key principles and indicative terms” to restructure 4.2 billion dollars in bilateral debt. China is Sri Lanka’s largest bilateral creditor, and Sri Lanka’s financial advisor for debt restructuring has assured the island nation’s authorities that China’s debt restructuring plan “is comparable” on the treatment.

China’s foreign ministry spokesman said a “tentative” agreement had been reached.

The IMF and other creditors are still waiting to see full details, according to reports.

“We will need some time to handle it,” State Minister of Finance Shehan Semasinghe told EconomyNext when asked if China had given a detailed debt restructuring plan to Sri Lankan authorities.

“But the only thing is [debt restructuring advisor] Lazard has assured that it is comparable in treatment. That is what the IMF also wants. The treatment to be shared with the other creditors,” he said.

Asked if comparability means equal treatment with the other creditors, Semasinghe said: “Equal treatment and comparability. That is what Lazard has informed us. It is our financial advisor. I cannot say anything beyond that.”