Sri Lanka does not need the International Monetary Fund at the moment and there will be no default State Minister for Money and Capital Markets, Nivard Cabraal said.

“We also seen several news reports, which referred to Sri Lanka’s need to go to the IMF and seek support, as well as get to be supported by the IMF,” he told reporters.

“We don’t have a need to do that. We do have a respect for the IMF and worked with them in the past as well. However, at this moment of time, we have identified the needs as well as the requirements of our economy.”

Sri Lanka has lost foreign reserves of the central bank (dollar deposits of the bank invested abroad) as new money (deposit slips or IOUs called banknotes) were created by the central bank against Treasury bills and issued to the government to pay state workers and other expenses.

However as the new deposit slips (rupee banknotes) come up for redemption in the foreign exchange market at a given convertible parity (exchange rate) foreign reserves have been lost.

Convertibility is now suspended for most trade transactions, leading to a weakening in the parity (depreciation) of the central bank IOUs (rupee paper) and others such as dollars.

Convertibility is still given to the government for rupees including those created after failed Treasury bond auctions, for debt repayments. As a result foreign reserves have declined steadily.

Minister Cabraal said several strategies were put in place to raise more funds to repay loans.

“And we are confident that with our plan that we have put in place, as well as the new initiatives that we are taking, we will be able to ensure that Sri Lanka will not have to default at any time in the near future, or even in the foreseeable future, or for that matter in the future at all,” Cabraal said.

“And we have the necessary resources as well as the commitment, as well as the plans that will give us the opportunity as well as the ability to make that happen.”

“So I want to reassure all those who may have been concerned, as a result of these reports that Sri Lanka would not be able to meet its debt, that we are very much having the ability to do so. And we have the commitment to do so as well.”

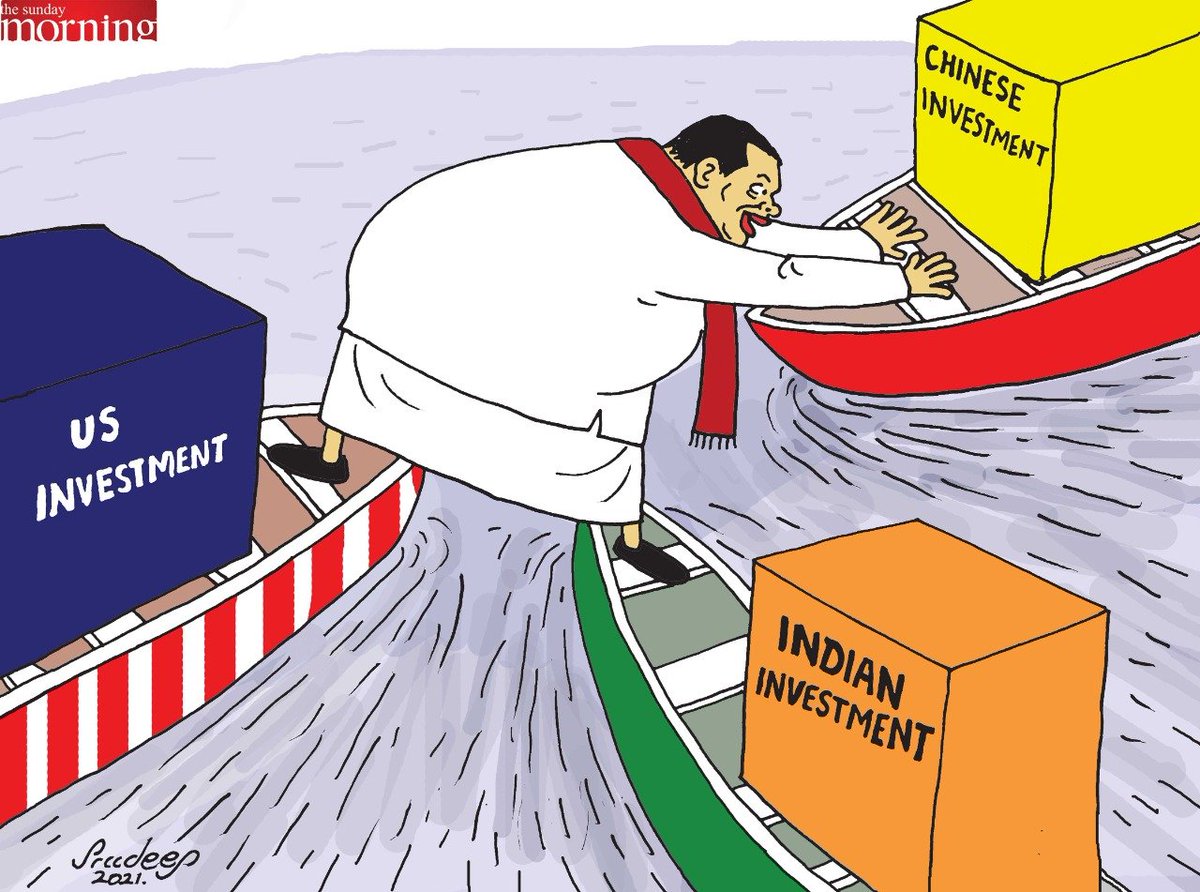

Sri Lanka’s central bank has raised money through swaps with the Bank of Bangladesh, the Treasury has borrowed from China and land sales are planned to foreign investors.

“We have the ability to continue with our impeccable record, and to ensure that all creditors are being settled in due time, we have seen some news reports even in the past, saying that Sri Lanka will default in 2020, 2019.