(CNBC) – Sri Lanka’s central bank governor told CNBC that the South Asian nation doesn’t need an economic lifeline from the International Monetary Fund (IMF).

“Well, we don’t need relief if we have an alternative strategy,” Ajith Nivard Cabraal said on CNBC’s “Squawk Box Asia” on Monday.

He claimed Sri Lanka is able to finance its outstanding debt, especially international sovereign bonds, “without causing any pain to our creditors.”

Credit agencies have recently warned Sri Lanka may need support to cushion the blow from inflation and foreign exchange headwinds, but Cabraal disagreed with that assessment.

He argued the government does not need to approach the IMF, especially if it is successful in finding government-to-government as well as central bank solutions in the short term.

“And we have a strategy to change that into something a lot more sustainable in the next one year or two,” Cabraal said.

Credit downgrades

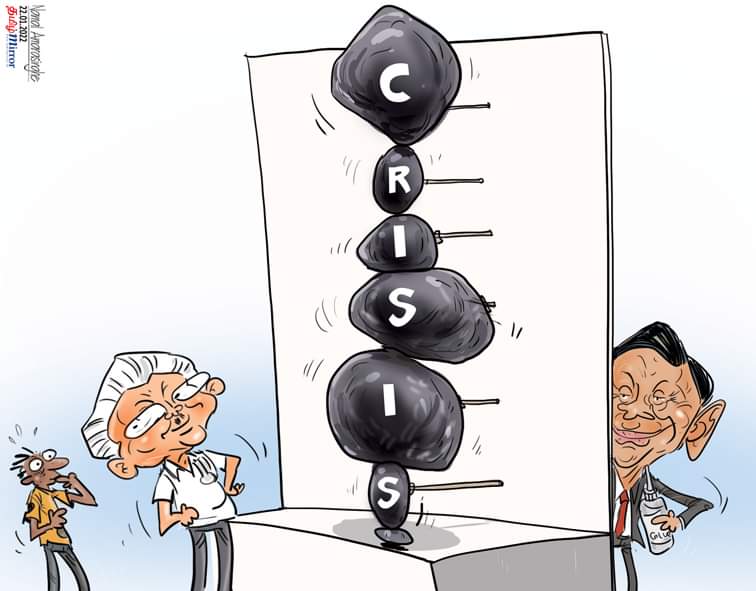

Earlier this month, S&P Global Ratings downgraded Sri Lanka from CCC+ to CCC with a negative outlook, indicating the country’s increasing financial vulnerability.

“Sri Lanka’s foreign exchange-denominated debt is vulnerable given the government’s declining foreign exchange reserves and high repayments. The government faces international sovereign bond maturities of US$500 million in January 2022 and US$1 billion in July 2022,” S&P said in a note.

This followed a similar move by Fitch Ratings in December to downgrade Sri Lanka from CCC to CC, suggesting imminent default.

“We believe it will be difficult for the government to meet its external debt obligations in 2022 and 2023 in the absence of new external financing sources,” said the report.

India has recently offered credit and foreign exchange support, saying the measures illustrate its commitment to Sri Lanka and its economic growth. That includes a $500 million line of credit to help Sri Lanka purchase fuel as the country grapples with surging inflation.

Inflationary pressures

Analysts are increasingly concerned about Sri Lanka’s inflationary problems, which they said could be amplified by foreign exchange issues.

“We think this foreign exchange scarcity will continue to fuel inflationary expectations, which can be only temporarily mitigated by Sri Lanka’s access to credit facilities from India, if a $1.5bn deal can be finalized. Moreover, elevated energy prices and risks from further administered adjustments to curtail losses in the electricity sector still loom,” Citi analysts said it a recent note.

While the government is likely to avoid IMF assistance for now, “we believe pressures will remain high going into the July bond maturity,” they added.

Sri Lanka’s benchmark inflation rate accelerated to 14% in December, up from 11.1% in November, according to data published Friday.

The central bank said food inflation hit 21.5%, noting price spikes for vegetables, rice and green chilies. Non-food inflation rose to 7.6% in December, which the central bank attributed to price hikes at restaurants, hotels as well as for alcoholic beverages and tobacco.

But Cabraal, Sri Lanka’s central bank governor, dismissed concerns about shortages.

“We don’t have any fuel shortage… There isn’t any shortage of medicines. We have imported $870 million worth of medicines last year,” he said.

“So just one or two items have been highlighted, but that doesn’t mean that Sri Lanka has any shortage. We have all the foodstuffs available. And I don’t think there’s any reason to say anything much of that,” added Cabraal.