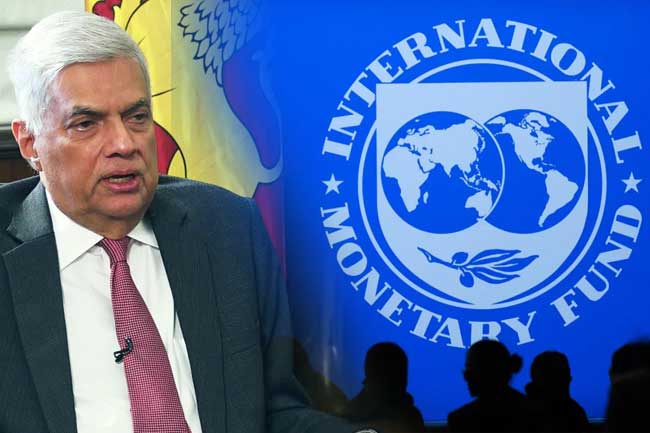

Sri Lanka is unlikely to get an International Monetary Fund deal in December as originally expected with delays in dealing with China and India which are out of the Paris Club as well as ‘bilateral issues’, President Ranil Wickremesinghe has said.

Sri Lanka has to get ‘creditor assurances’ on debt restructuring from bilateral lenders before the IMF’s executive board endorses a reform program formally.

Unlike other countries which got into default, two out of three main creditors of Sri Lanka were out of the Paris Club of creditors who had already had a well-oiled mechanism for dealing with debt re-structuring.

“I first went to the Paris Club where all the creditors were from the West and Japan,” President Wickremesinghe told a forum of tea factory owners in Colombo.

“However, we are in a unique position today where out of our three main creditors, only one belongs to the Paris Club. Japan.

“The other two are not in the Paris Club. They are India and China.”

He said China started debt restructuring with Zambia.

There were also ‘bilateral issues’ to deal with, he said without elaborating.

“I think India has it for the first time with Sri Lanka,” President Wickremesinghe said. “I have already started discussions with Japan and now with India and China.

“We get down to a common platform of how we can resolve it while we also have discussions on bilateral issues that affect each other’s countries.”

China has just finished its party conference where senior officials had change.

“If we can move and come to an agreement by December, which means coming to an agreement by mid-November, and going up to the IMF Board in mid-December, we will gain a big advantage,” Wickremesinghe said.

“However, I don’t know whether we can do it for the simple reason that in China, the focus has started now after the party conference. However, we must aim to have it by January.”

Sri Lanka IMF deal nod could be Jan 2023

Sri Lanka however has made most of the corrections required to regain monetary stability.

Balance of payments troubles are problem associated with reserve collecting central bank which mis-target interest rates with printed money through a policy rate incompatible with domestic credit trends. Active open market operations were begun by the Federal Reserve in the process of triggering the Great Depression in the 1920s.

When a country with a central bank with a history of chronic mistargeting of rates – Sri Lanka had gone to the IMF 16 times before – gets market access its tends to default.

The key reason third world countries get into balance of payments trouble is money printed to keep policy rates too low by soft-pegged central bankers which fires unsustainable credit and balance of payments deficits.

Sri Lanka has also raised taxes to reduce central government credit and hike tariffs of public utilities to reduce or eliminate their borrowings.

The central bank has also lost the ability to intervene and sterilize interventions with new money after the intervention effectively losing its ability to generate BOP deficits from around August.