Sri Lanka’s foreign remittances fell to 271.4 million US dollars in November 2021 as credibility of the soft-dollar peg was lost to liquidity injections and record volumes shifted to the unofficial cross border settlement market.

Foreign remittances hit 266.3 million US dollars in April 2009, when the rupee was floated after the pegs credibility was declined amid sterilized interventions of mostly bond buyer exits though monetary policy was tight.

Sri Lanka’s official remittances which fell amid global and domestic lockdowns to 375 million US dollars in April 2020, rapidly recovered.

Several workers in the Middle East told EconomyNext at the time that they were having more savings with reduced domestic shopping, entertainment and travelling due restricted movements which had increased the saving available to be remitted home.

However remittances started to fall from around February as Sri Lanka domestic economy and credit recovered and the central bank printed money to keep rates down and restricted convertibility, triggering parallel markets.

Sri Lanka’s forex reserves have declined steadily after rates were cut and liquidity was injected to enforce the lower call money rates.

In November forex reserves hit 1.6 billion US dollars.

The remittances which were 446 million US dollars in August started to fall as a 200 to the US dollar peg was strictly enforced and banks were barred from buying dollar from remittance houses above the rate and the family members of expatriate workers.

Analysts had warned that any domestic economic recovery will hit the peg given the policy rates and easy liquidity injections.

The kerb rate has hit around 240 to the US dollars.

The central bank is giving a 210 to the US dollar parallel exchange rate to expatriate workers and exporter and resident foreign salary earners have been asked to force convert dollars.

In December remittances usually go up as expat workers try to send more dollars home.

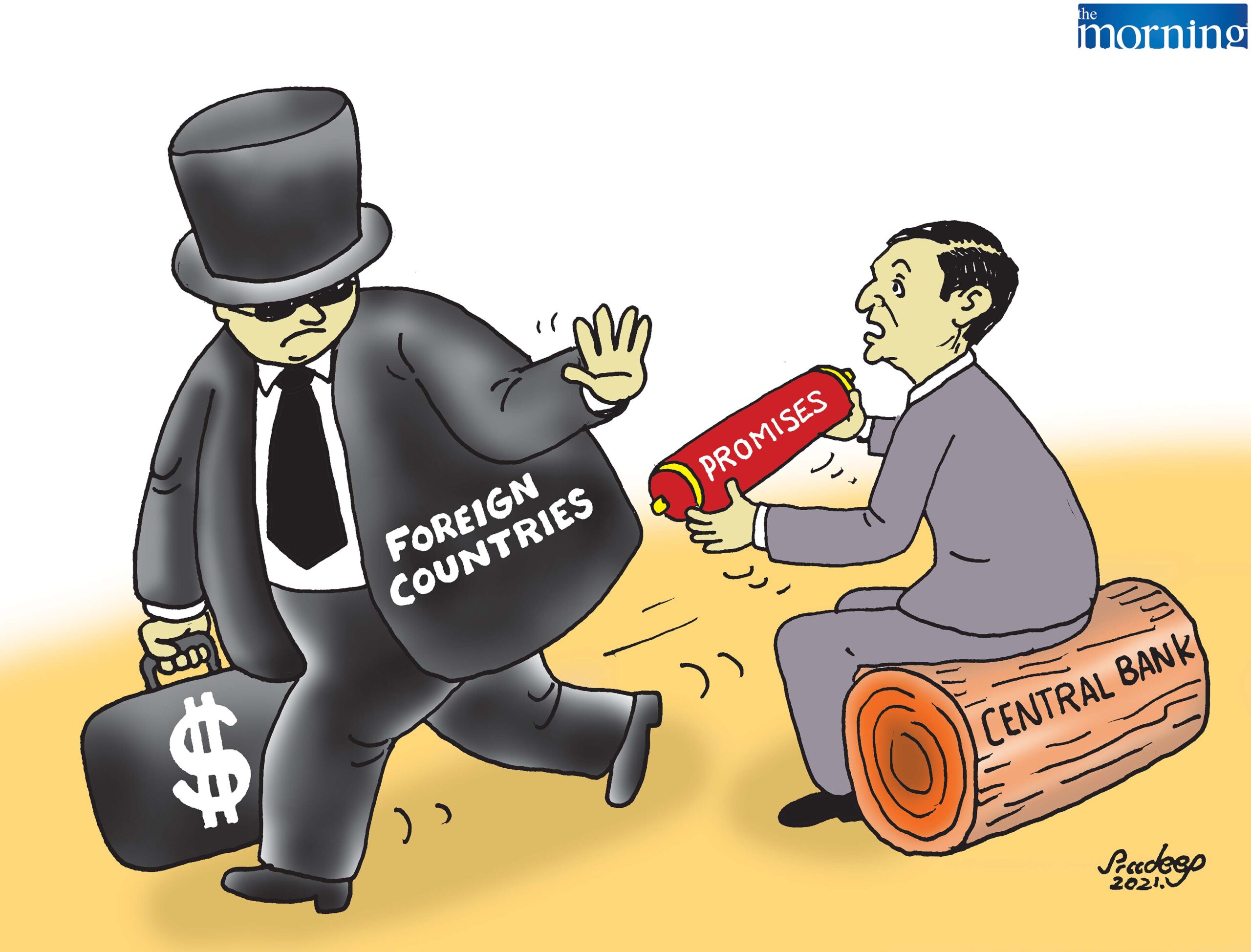

Sri Lanka has been trying to shore up reserves with foreign borrowings, amid a steady drain of reserves lost to liquidity injections to obstinately target calm money rates.

Sri Lanka has also borrowed reserves from Bangladesh, which has a somewhat better monetary policy framework and stronger reserves.

However the Bangladesh Taka also came under pressure as the economy recovered and the central bank lowered its policy rate from 5.25 percent to 4.75 percent in July.

Foreign reserves which hit 47 billion US dollars in August 2021, from 42 billion dollars in December 2020 has come under pressure as Bangladesh Bank defended the Taka.

Foreign reserves by over 2 billion US dollars to 44 billion US dollars in November as the central bank sold dollars.

However the Bangladesh central bank does not obsessively target the call money rate unlike in Sri Lanka triggering liquidity shortages in over-trading banks.

The average call money rate topped 4 percent in late November, from around 1.7 percent at the beginning of the year as the Taka was defended.

The kerb market for Taka has also moved up to around 90 to the US dollar from the official rate of around 85, driving remittances to the unofficial market.

The central bank of Bangladesh has kept the Taka below 85 to the dollar over 12 years giving stability to the country, though officially it targets M2.