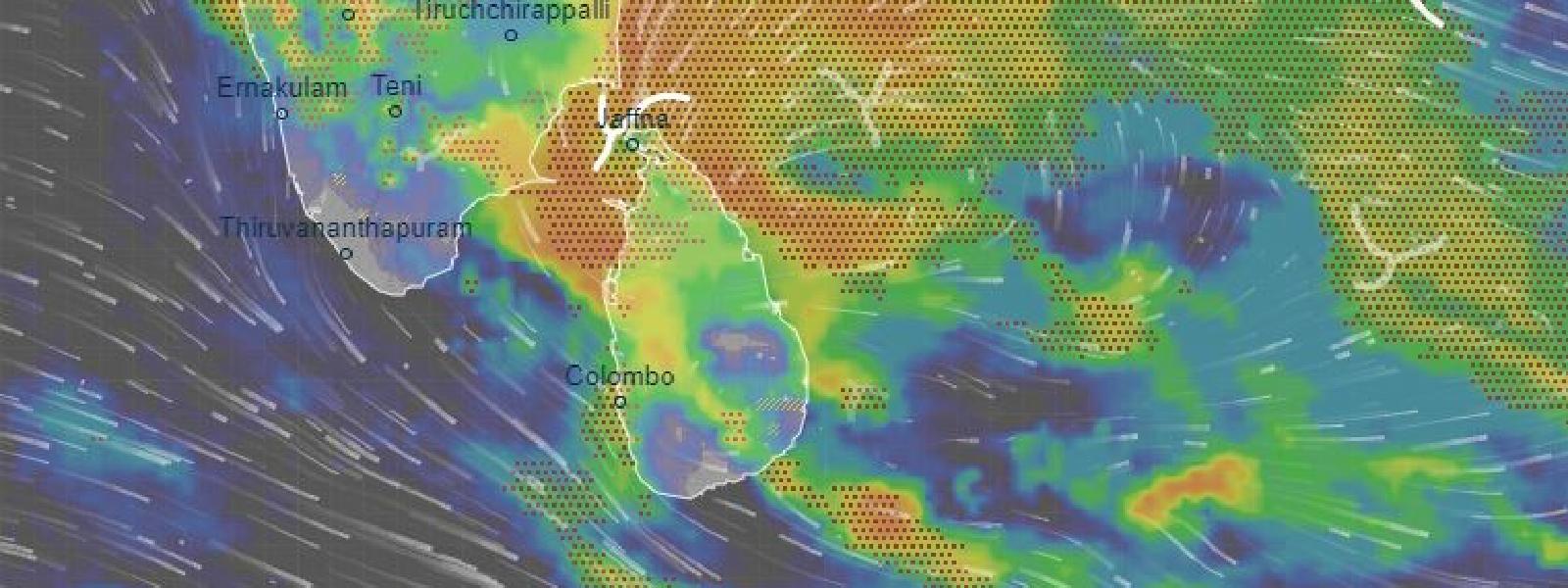

The British High Commission in Colombo says that the United Kingdom (UK) is stepping up support for Sri Lanka after Cyclone Ditwah, increasing UK humanitarian aid to a total of £1 million ($1.32 million).

It said that UK aid is already reaching Sri Lanka’s hardest-hit communities with life-saving support and early recovery.

“With 1.8m people affected, we’re now providing additional funding — bringing Britain’s support to £1m ($1.32m). Grateful to Red Cross, UNOPS, Vriddhi & partners delivering relief,” the British High Commission said on ‘X’.

Earlier, the UK had announced £675,000 ($890,000) in emergency aid to support families impacted by Cyclone Ditwah.

The assistance, delivered through the Red Cross, UN agencies, and local organisations, includes shelter materials, clean water, sanitation facilities, and other essential supplies for communities that have lost homes and livelihoods.

During a meeting with Minister of Foreign Affairs Vijitha Herath, Acting British High Commissioner Theresa O’Mahony reaffirmed the UK’s commitment to supporting Sri Lanka in its recovery from the severe weather impacts.

In a separate message, His Majesty the King conveyed his heartfelt condolences to all those affected by the disaster, praising the courage of emergency responders and volunteers providing relief.

The UK stated that this support reflects the long-standing partnership and friendship between the two nations, reaffirming its solidarity with Sri Lanka during this difficult time.