ECONOMYNEXT – In a diplomatic maneuver that would have been unthinkable just a few years ago, Tilvin Silva, the General Secretary of the Janatha Vimukthi Peramuna (JVP) and the ideological heavyweight behind Sri Lanka’s ruling National People’s Power (NPP), concluded a landmark 8-day official visit to India this week.

The visit, from February 5-12, marks the first time the veteran Marxist leader has set foot on Indian soil, signaling a definitive end to the party’s decades-long anti-India stance.

Accompanied by a high-level delegation, Silva was hosted under the Indian Council for Cultural Relations’ (ICCR) Distinguished Visitors Programme. The current Sri Lanka President Anura Kumara Dissanayake also was an invitee under the same programme two years ago before he became the president.

Silva’s itinerary, covering New Delhi, Ahmedabad, and Thiruvananthapuram, was carefully curated to showcase India’s digital, agricultural, and industrial prowess.

The Beijing Prelude

The timing of this visit is strategically significant.

It follows Silva’s high-profile tour of China in June 2025, where he sought to study the “Chinese Model” of development and party discipline.

By following a Beijing expedition with a New Delhi “reset,” Silva is executing what regional analysts call strategic hedging.

For a party that once viewed Indian intervention as an existential threat to Sri Lankan sovereignty, the shift is stark.

Historically, the JVP spearheaded two bloody insurrections, with the 1987 uprising specifically targeting the Indo-Lanka Accord.

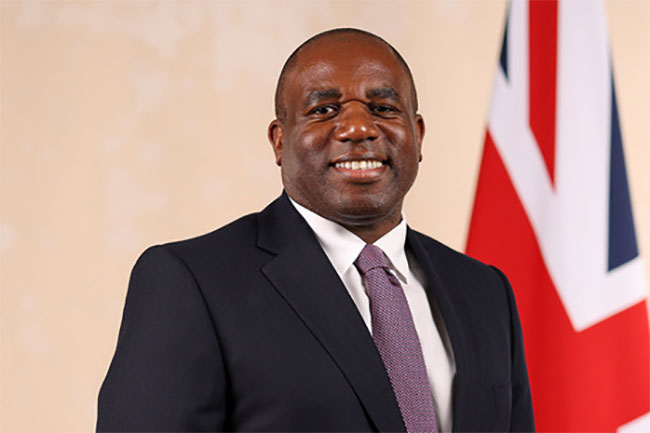

Today, however, Silva is seen engaging with Indian External Affairs Minister S Jaishankar to discuss growth opportunities and mutual benefit.

But local geopolitical analysts say Silva’s move could be due to the current geopolitical chess game with higher uncertainty created by US President Donald Trump’s tariffs.

They say there is hardly any change in anti-Indian sentiment within hardcore JVP supporters.

From Protests to Partnerships

In New Delhi, the delegation was briefed on India’s Neighbourhood First policy and the ‘MAHASAGAR’ vision.

Beyond mere rhetoric, Silva’s visit to learn about the Unique Digital Identity Authority of India (Aadhaar) and the Gati Shakti infrastructure plan suggests a government eager to modernize Sri Lanka’s bureaucracy using Indian technical blueprints, analysts say.

Silva, who himself along with his party criticized private-public partnerships and foreign monopolies, visited AMUL and the Gujarat International Finance Tec-City (GIFT City).

The delegation also studied the “Gujarat Model” of inclusive development, a move that underscores the JVP’s transition from a revolutionary movement to a pragmatic governing force, analysts say.

The De Facto Power

While Dissanayake holds the presidency, Silva’s position as General Secretary in the JVP’s politburo structure makes him the de facto ideological compass of the state.

Analysts see his visit to the Vizhinjam Deep-Water Container Transshipment Port in Kerala, a project developed via a PPP model, as a move of NPP’s willingness to move away from rigid Marxist dogma toward a developmental realism that welcomes regional cooperation.

As Sri Lanka continues to navigate a path out of its economic crisis, Silva’s Indian tour serves as a clear message that the “Red” party of the past has been replaced by a government that recognizes New Delhi as a trusted partner, successfully balancing the scales between the two Asian giants.