In February, the finance ministers of G20 countries met to discuss the challenges facing the global economy. It was a missed opportunity to help Sri Lanka, a country on the front line of the debt crisis that has enveloped dozens of nations around the world in recent years.

It was disappointing that the final chair’s summary and outcome document only paid lip service to alleviating the challenges faced by people in Sri Lanka.

While it recognised the “urgency to address debt vulnerabilities” globally, and “look[ed] forward to a swift resolution to Sri Lanka’s debt situation”, no concrete commitments were made or actions taken.

The G20 countries include Sri Lanka’s main bilateral creditors including China, India, Japan and South Korea; as well as influential members of multilateral creditor organisations, including the United States and European nations. If this group collaborated effectively, it could make debt relief available to Sri Lanka, and strengthen the protections of people’s economic and social rights during a moment of crisis.

Because while the news cycle may have moved on, Sri Lanka’s economic crisis is still raging and having a devastating impact on people. High inflation and limited social protection, combined with difficulties accessing essentials like food and healthcare, are exacting a heavy toll on their lives and rights.

According to the World Food Programme, for example, one in three households was food insecure in December 2022. Prospects for 2023 are also not encouraging: a quarter of people are projected to remain in poverty, and according to the World Bank, a significant economic contraction is likely.

Sri Lanka’s debt burden affects the ability of the government to guarantee human rights. The public debt-to-GDP ratio increased from 93.6 percent at the end of 2019 to 114 percent at the end of 2021.

Even before the economic crisis made international headlines, Sri Lanka was a global outlier in the amount it spent to service its debt. In 2020, before the most recent crisis, an incredible 71.4 percent of government revenue was spent simply on paying interest versus a global average of 6 percent and a regional average of 21.1 percent.

Interest payments are the single largest category of government expenditure, and a lot of fresh government borrowing was used simply to pay the interest on Sri Lanka’s previous loans.

Servicing this debt has reduced the government’s ability to spend on sectors like health, education and social protection, which directly impact people’s welfare. A survey this month found that half of the families in Sri Lanka are forced to reduce the amount they feed their children.

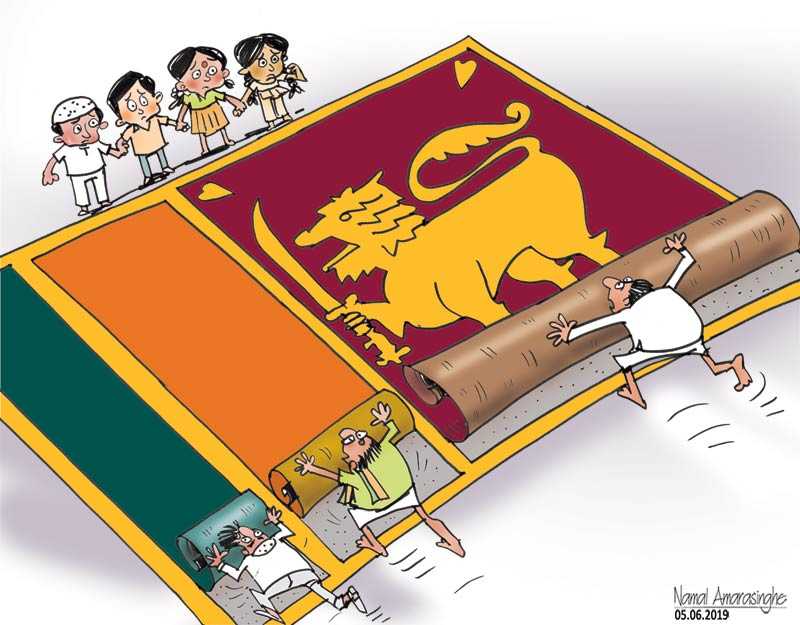

It is essential to release Sri Lanka from this debt trap, to break a spiral that is eroding the human rights of too many of the island’s 22 million people.

Sri Lanka’s government is currently engaged in complex debt negotiations, which are vital to access financial support from the International Monetary Fund. The IMF concluded a staff-level agreement with the government last year, offering to lend about $2.9bn. However, the terms of the IMF agreement required sufficient assurances of debt restructuring and relief from Sri Lanka’s creditors before the loan was finalised and money disbursed.

While IMF financing may be the reason Sri Lanka’s debt is in the news today, creditors should focus on resolving debt so economic and social rights can be better guaranteed. Past IMF programmes have included conditions which had adverse human rights impacts, such as cuts in public spending and other austerity measures. Workers in Sri Lanka recently went on strike against measures the government implemented to purportedly secure IMF financing, such as increased taxes.

Sri Lanka’s debt negotiations are complicated for several reasons, including the range of parties involved. Almost half of Sri Lanka’s total external debt is in bonds on the open market and owned in part by private entities such as hedge funds. One of these private creditors has already sued the Sri Lankan government in an American court for debt repayment. Then there are bilateral creditors, and some debt is also held by multilateral institutions like the Asian Development Bank and the World Bank Group.

While there appears to have been some progress in these negotiations in recent weeks, no resolution appears in sight. A lack of transparency in how talks are being conducted means it is unclear what the blockages are and how long the process might take.

How these negotiations are conducted is important. The very fact that Sri Lanka’s existing debt repayments are so onerous raises questions about how such agreements were entered into in the first place. Transparency, participation and accountability are essential to ensure that the current crisis is not repeated.

Sri Lanka’s creditors cannot only be guided by their commercial or national interests. As an Amnesty International report on Sri Lanka’s economic crisis from October 2022 noted, international financial organisations, multilateral developmental banks and private corporations have obligations and responsibilities to respect international human rights.

As these negotiations progress, debt restructuring and relief should enable Sri Lanka to service its external debts without compromising its capacity to fulfil its human rights obligations, and guarantee people’s economic and social rights. All options for debt relief should be on the table, including debt cancellation if necessary.

Urgent, coordinated international action is key to ensuring that the Sri Lankan government can effectively tackle the crisis and protect people’s rights. It is almost a year since Sri Lanka first defaulted on its debt, and six months since the IMF staff-level agreement was concluded.

More G20 meetings are scheduled for this year, and they must prioritise debt relief for Sri Lanka in line with human rights standards. Postponing decisive action on Sri Lanka only delays recovery and adds to the human suffering people are experiencing in the country.

The views expressed in this article are the author’s own and do not necessarily reflect Al Jazeera’s editorial stance.