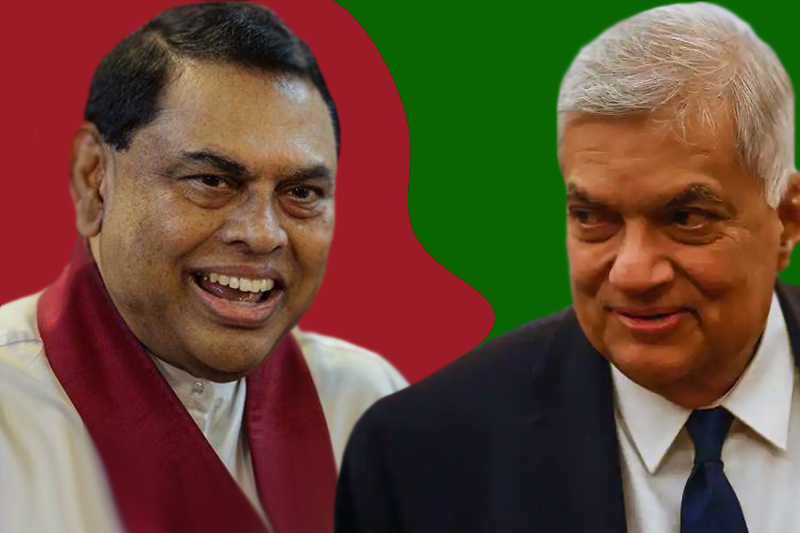

Commenting on the upcoming elections, President Ranil Wickremesinghe said that regardless of any court challenges, the presidential election will be held this year.

He also indicated that arrangements will be made to hold parliamentary and provincial council elections following the presidential election.

President Wickremesinghe made these remarks while attending Mr. R. Sampanthan’s funeral at his residence in Trincomalee this yesterday (07).

Sampanthan championed the rights of all Sri Lankans

President Ranil Wickremesinghe paid tribute to the late Mr. R. Sampanthan, acknowledging him as a leader who championed the rights not only of the Tamil people but also of all Sri Lankans.

Emphasizing that both Mr. Sampanthan and himself were committed to the cause of an undivided Sri Lanka, the President urged everyone to unite in successfully concluding the discussions initiated with Mr. Sampanthan.

The funeral ceremony, honouring the former Leader of the Opposition and former leader of the Tamil National Alliance (TNA), as well as the late Trincomalee District Member of Parliament, was attended by numerous political leaders, both from the Government and the opposition.

Reaffirming his commitment to addressing the issues faced by the Tamil people which Mr. Sampanthan consistently advocated for, President Wickremesinghe announced that the draft of the National Land Commission Bill is ready to be submitted to Parliament.

He said this commission will have the authority to resolve issues faced by the Sinhalese, Tamil, and Muslim communities in coordination with the Department of Forest.

The President appreciated Mr. Sampanthan’s role as Leader of the Opposition, highlighting that an opposition leader is essentially an alternative prime minister. He praised Mr. Sampanthan for displaying the qualities of a true opposition leader by addressing the concerns of all Sri Lankans, not just the Tamil community.

Speaking further, President Wickremesinghe said;

“It is declared necessary to hold provincial council elections. However, we have discussed and decided to hold the presidential election first. Regardless of any legal challenges, the presidential election will be held this year. Following that, parliamentary elections will be conducted, and then provincial council elections will be held.

Due to the complexities in the new system, requests were made to hold the provincial council elections according to the old system. There was an agreement among us for that. It was decided to ensure women and youth representation and to allow parliamentarians to compete for these elections while retaining their membership.

By implementing the 13th amendment, we are negotiating with the Chief Ministers who are now represent the Parliament to transfer a number of other powers from the central government, excluding police powers. Other powers can be discussed later.

As a new proposal, the government has suggested decentralizing maximum power within the framework of the 13th amendment in the distribution of power.

Additionally, the report of the Nawaz Commission needs to be discussed. The Foreign Minister has informed me that the drafted bill of the Truth, Unity and Reconciliation Commission (TRC) is prepared to be submitted to Parliament.

Moreover, we have discussed and reached an agreement on the Jana Sabha system. We intend to take these discussions forward and bring them to a conclusion.”