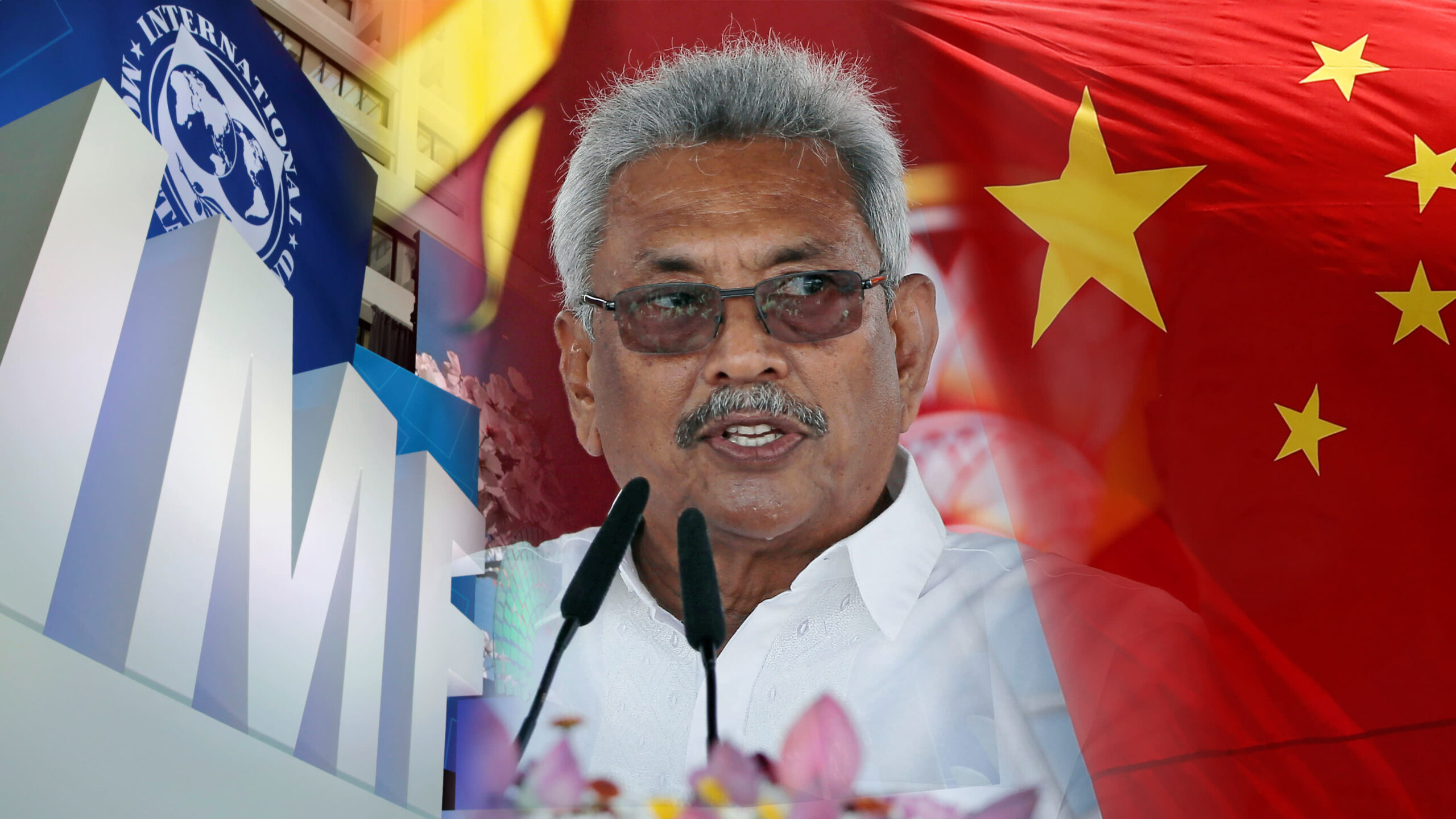

Despite concerns over looming sovereign debt default, Sri Lanka will not seek any International Monetary Fund (IMF) loans but only technical support, President’s Secretary P B Jayasundera said.

Jayasundera, former finance secretary who still has influence over the island nation’s economic policies said the debt stress can be managed.

“We have a strong relationship with the IMF, that is on technical side, foreign exchange management, customs reforms,” Jayasudera told EconomyNext his presidential secretariat office in the country’s old parliament.

“But on the loans, we are not seeking any of loans because right now our interest is not looking for loans, but we are looking investments and how to put the investment climate here. So, no interest is shownfor an IMF loan facility.”

Moody’s Investors Service last week placed Sri Lanka’s Caa1 ratings under review fordowngrade, citing the country’s increasingly fragile external liquidity position and rising risk of default. The government hit back at the Moody’s assessment and said it will honour all the debts.

Moody’s Investors Service last week placed Sri Lanka’s latest Caa1 ratings under review fordowngrade, citing the country’s increasingly fragile external liquidity position and rising risk of default. The government hit back at the Moody’s assessment and said it will honour all the debts.

Global analysts have raised concerns over a default in 2022 unless the country goes for an IMF program with fiscal and monetary fixes and debt restructuring.

Jayasendera, however, said the country is facing a “stressful July” with having to manage a higher volume of foreign debts as well as other import-related outflows in the same month.

“Not only we do have to repay the one billion sovereign bond, but last week we also had to pay some other loans of 400-500 million dollars. For that bunching is the one we have to carefully reprofile,” adding that the cost of vaccination also has to be managed.

US-based investment bank Goldman Sachs in a note last week said its “calculations show that Sri Lanka should comfortably meet its external financing requirements in 2021”.

President Gotabaya Rajapaksa’s administration is shy of tapping international capital markets, fearing such move could increase the borrowing cost. Sri Lanka’s 2021 January bond is offered at around 26 percent, indicating a higher borrowing cost if the country goes for a fresh Eurobond.

However, he said the 2021 overall balance-of-payments will be better than last year with 7.8 billion dollars of expected from remittances and 1.7 billion dollars from information technology related services.